<<< Go to start <<<

Page 3 of 3 | 1 | 2 | 3 |

Which brings me back to where I started: Stansberry’s message that America is doomed. In the wake of VaxGen, oil shale and his “super insider tip”, is he a man with a judgment to be trusted?

Certainly some people are sure that he is, despite the many mishaps who buy his reports.

“After 20 years of reading ALL of the mainstream investment letters and following the lives of there founders… you are clearly one of the very few that is telling the truth… not only about investments but much more sadly…our Government,” one James Shovlin wrote to Stansberry. “You are NOT alone and there are thousands who understand and believe what you have written and in you personally.”

“Bon Courage Porter!” wrote one Richard Delt. “You fellows have been right for years.”

Stansberry’s China syndrome

“But,” as Porter Stansberry himself notes in his doomsday report, “I’m getting ahead of myself just a bit.”

What was he saying about us needing to lay up stores of food, water and medicines to last at least six months?

“Let me back up and show you in the simplest terms possible what is going on, why I am so concerned, and what I believe will happen in the next 12 months…”

“In short, I believe that we as Americans are about to see a major, major collapse in our national monetary system, and our normal way of life.”

To cut to the chase, he says much of this is coming from China, which he says is “getting out of the dollar”. Of course, some fringe economists have been proposing this for years. But Stansberry takes it to a new level of hysteria.

“China holds more US dollars than anyone else on the planet. But China is getting out of the US dollar as fast as they can without crashing their own economy.”

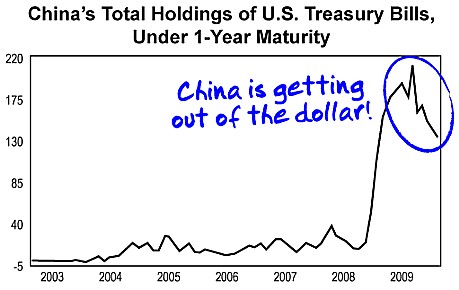

Cynics might say that getting out of the dollar without crashing your economy sounds like something of a contradiction in terms. But Stansberry has a graph, which makes his point as only such graphs can do.

I don’t know about you, but it looks like something we bashed out as 11-year-olds. Why under one year? What is the y axis telling us? Whose data is this meant to be anyhow?

But Stansberry doesn’t stop at China. Everybody’s getting out. Even America doesn’t want to hold the greenback.

“Most Americans don’t know that some states in the Mid-West are already using “alternative currencies,” he tells us, explaining that an NBC affiliate in Michigan had reported that “new types of money are popping up across Mid-Michigan and supporters say, it’s not counterfeit, but rather a competing currency. Right now, for example, you can buy a meal or visit a chiropractor without using actual U.S. legal tender.”

“Many places in Texas now accept Mexican pesos for payment. ‘Euros Accepted’ signs are popping up in of all places: Manhattan. And not only Manhattan, but in New York’s favorite summer playground… the Hamptons.”

And even some Washington DC stores, he says, “just 25 miles from my office” have begun accepting euros. And that’s worrying.

“You see, no matter what the government decides, stores and businesses will accept whatever they believe is a strong currency.”

Stansberry’s solution is… gold (and silver)

At last to the conclusion. What the investor should do is get a slug of their wealth out of currency. With your water, food and medicines sorted, the next essential to survive the meltdown is not black gold. It’s gold gold. Here is the nub of Porter’s plan.

Rightly noting that precious metals have traditionally been seen as a place of safety in troubled times, this is his remedy for the coming crisis.

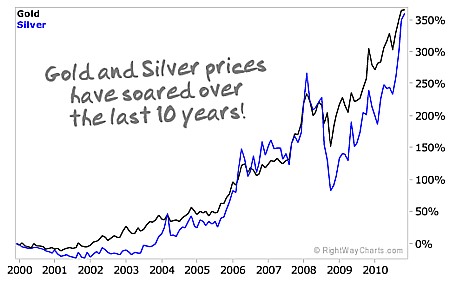

“What I’m talking about here is buying as much gold and silver as you can reasonably afford. I know… gold has had a huge run, jumping more than 300% in the past decade.

“But believe me, when the US dollar loses its status as the world’s reserve currency, this early run is going to be a mere afterthought.

“I will be surprised if gold does not reach $5,000 or $6,000 an ounce in the next few years.”

And, would you believe it, Stansberry & Associates, has just the tool to help you buy it. His firm has recently published a “great book”, called “The Gold Investors Bible”, which details, in full, apparently all of the best ways to own and hold gold bullion.

In this handy volume, the man who brought you VaxGen and himself a catastrophic fraud prosecution, reveals what he assures us are “dozens of secrets about the gold industry”, “why some gold coins are better than others”, how to buy gold with “ZERO dealer markup,” and, of course, “so much more”.

“Not regularly available for sale, this book is valued at $24. I’d like to send you a copy, totally free of charge.”

There’s a bunch more stuff, including the exclusive news of what is “the world’s most valuable asset in a time of crisis”.

All you have to do is take a subscription to his monthly “Stansberry’s Investment Advisory”. At a 50% discount from it’s usual $99 a year, that’s $45.50 – the same as you would have paid for the dope on the Green River Formation.

“Dear Porter, I’ve heard that there’s a bubble in gold…”

Forget it. Just look at the graph.

But, now let’s go further back, and see if history has lessons when we look beyond the picture Porter paints. Here are the metal’s prices since 1974, soon after Richard Nixon took America off the gold standard (in August 1971).

“I see no bubble” the pirate Porter would surely tell us, at 50% of the regular price. But after years of watching from the sidelines, I can’t help thinking that some of us have been here before.