Insight Investor

Words of gold

Award-winning investigative reporter Brian Deer reviews an expert analysis on the prospects for gold, and asks whether the metal’s many admiring investors have it right

That’s what some people call it. “The most valuable asset in a time of crisis”. Or even: “The world’s most valuable asset in a time of crisis”. And, of course, they’re talking about gold. Sometimes it seems as if an hour on Planet Earth doesn’t pass without some hot new analysis of why gold’s price will rise.

Even the soberest commentators seem bedazzled.

Of course, there are many arguments as to why gold is indeed a sound investment in this seemingly fragile age of fiat money. Surely, what better store of wealth than a metal in short supply – one that governments can’t print or chisel. Unless a rogue asteroid slams into us, chock full of the gold stuff, or some as-yet-unborn boffin can find a way to pull it out of seawater, the best estimates suggest that it’s literally running out, with more than three quarters of Earth’s store already mined.

One prominent advocate of holding gold is the Baltimore tipster Porter Stansberry. I’ve written about him often, particularly his federal fraud prosecution. But, of course, siren whispers are everywhere in the investment advice universe, urging you to take a punt:

“Why gold is heading for $10,000 an ounce.”

“A balanced portfolio needs gold.”

“Buy PHYSICAL gold NOW: The Discount of a Lifetime.”

Gold as a hedge against inflation

Perhaps the best argument pitches gold against inflation. Surely, the metal is safer than money? As the central banks printing presses magic away sovereign debt like godly scrubbers forgiving humans our sins, gold, the theory goes, can protect your savings: the ultimate protection against rising prices, a safe haven for the wise in difficult circumstances.

“Gold has long been touted as the ultimate hedge against hard times,” declares, for example, investment advisor Jay MacDonald. “They don’t call it the gold standard for nothing; central banks the world over stockpile the stuff to defend the value of their currencies.”

Strong stuff, if a tad simplistic. But, in its core proposition, is this right?

Two of the many people who have tried to find out over the centuries are Claude B Erb and Campbell R Harvey of the US National Bureau of Economic Research. In April 2013, they published a 48-page paper analysing the various arguments for gold. And, of course, at the top of their list was the familiar belief that it offers us a hedge against inflation.

I’ll summarise their case, so as to save you time. And, most importantly. I’ll show you some charts. The men have published many more, but I think these are the keys, painting a quick-to-grasp picture of their conclusions.

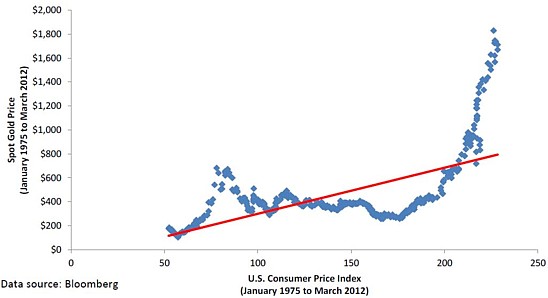

The chart below is a useful starting point. Like most they use, it relies on Bloomberg data. It shows the end-of-month value of the nearby gold futures contract versus the monthly reading for the United States consumer price index. The period in review starts in January 1975 (after the right to private ownership of gold was restored in the US in December 1974) and ends in March 2012.

The red regression line shows that, on average, the higher the level of the CPI, the higher the price of gold. “This line roughly portrays the implied price of gold – if gold was driven by the CPI,” Erb and Harvey explain. “However… the price of gold swings widely around the CPI. The inflation derived price of gold and the actual price of gold have rarely been equal.”

Of course, there are plenty of ways to track gold’s performance. A simpler one (it seems logical) is to track the real price of gold. That’s the ratio of the nominal price, that you see on market boards, to relative changes in consumer prices. On the next page is a chart that reveals this information, year by year, since 1975.