<<< Go to start <<<

Page 3 of 4 | 1 | 2 | 3 | 4 |

Two Stansberry people, one month apart. Maybe they know something we don’t. But from 7 August, when Matt Badiali made his claim, gold did not double, but rose a little then fell back, until two months later it was back where it began. A medium term downward drift was unabated.

Which is not to say that Porter Stansberry’s people didn’t cover themselves against this possibility. After predicting that gold prices might double over the remainder of the year, Badiali slipped in, further down his August teaser:

“Will gold hold steady at $1,300? Will it slump to $1,000? Will it rally to $1,800 if the global monetary system suffers another earthquake?

“We can’t know for sure.”

But in his pitch to Stansberry & Associates’ huge mailshot and website readership, Matt Badiali slips in something else. Between the grabbing headline predicting up to 100% gains in gold prices, and his admission that the price might fall and, in any event he doesn’t know, he deploys Porter Stansberry’s more recent technique.

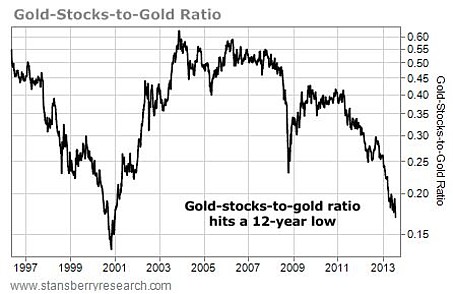

Gold-stocks-to-gold ratio

Rather than claim any particular inside information (which was what got him into trouble with the Securities and Exchange Commission), he teases readers with a chart. And analysis of this explains much about Stansberry’s current approach to attracting customers.

At face value, this chart is compelling, and worthy of your careful study. It compares the price of gold the metal against the price of gold stocks. “When the ratio is very high, it means gold stocks are expensive relative to gold,” Matt Badiali explains. “When the ratio is very low, it means gold stocks are cheap relative to gold.”

Badiali continues, with apparent persuasiveness: “The ratio was at its most extreme in November 2000. After that ratio was reached, gold miners soared 435%. In 2008, another extreme point was reached. Gold miners soared more than 150% in the next 12 months.”

And: “Now look at the right-hand side of the chart. The gold-stocks-to-gold ratio is at a 12-year low. It hasn’t been this low since January 2001.”

In other words, buy gold now (as if there is any other free message on gold). If Stansberry & Associates can generate this kind of scientific data for investors, who are we to sulk on the sidelines?

But the only trouble is, Badiali’s argument is for dopes. As the bigger picture, on the next page, will show.