<<< Go to start <<<

Page 3 of 3 | 1 | 2 | 3 |

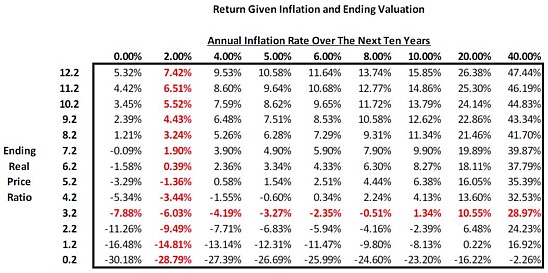

So what are the implications, spelt more clearly for the investor, of the kind of reversion that the authors note? One factor, of course, would be the rate of inflation over, say the next ten years. Looking at the yields of 10 year nominal US Treasury bonds and 10 year inflation linked Treasury bonds, Erb and Harrison show that it’s possible to generate a “market implied” 10 year inflation forecast.

At the time they wrote, the “break even” inflation rate over the following 10 years would be about 2% a year. But there are many possibilities, and these are charted, giving, again, a less than spectacular forecast.

The easiest way to read this is by going to the historical average real price ratio against the CPI of about 3.2 (see the far left – “y” – axis), and following the line across for varying inflation rates.

Rates of return on gold under different inflation scenarios: over 10 years, the outlook is rarely promising

On the basis of this table, one could conclude that, if inflation averages 2%, then the real return on gold over ten years would be minus 6.03%. Yes, indeed, minus six percent. In fact, on their tabulated reckoning, the inflation rate would need to be 10% annually before the real returns move into positive territory. And even then it would be a measly 1.34%.

Anybody spot a gold bubble?

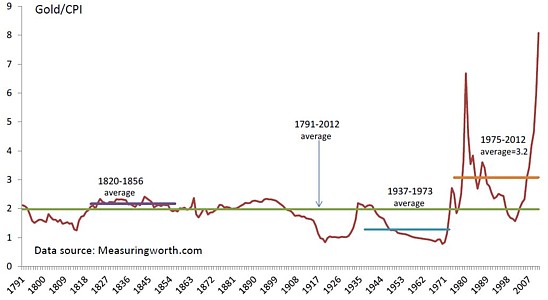

I must admit that I wonder about very long term historical data. But, if vaguely reliable, then the picture is yet clearer: what goes up, must surely come down. Nothing new. Going right back to 1791 (which does seem pretty risky), what jumps off the page is a sense of the bubbles, especially the pair since 1975. Not much of a hint here of a hedge against inflation. A few speculative moments. Nothing new.

Indeed, Erb and Harvey (who set this all out in more detail and depth in a paper titled “The Golden Dilemma”, published in revised form in April 2013) conclude from this chart that the real price of gold fluctuates rather than rises and seems to have been more volatile recently than during the previous two centuries or so.

Thus, to answer the question (well, at least in some aspects), they aren’t what you might think of as hopeful. For those who think that gold is a valuable asset for a crisis, it might be time to pause and have another think.

“In ‘normal’ times, gold does not seem to be a good hedge of realized or unexpected short-run inflation,” Erb and Harrison conclude. “Gold may vey well be a long term hedge. However, the long-run may be longer than an investor’s investment horizon or life span.”